Calculating margin from cost and selling price

Number of units purchased. This is why a retailer is more likely to price a product at 1999 rather than 2000.

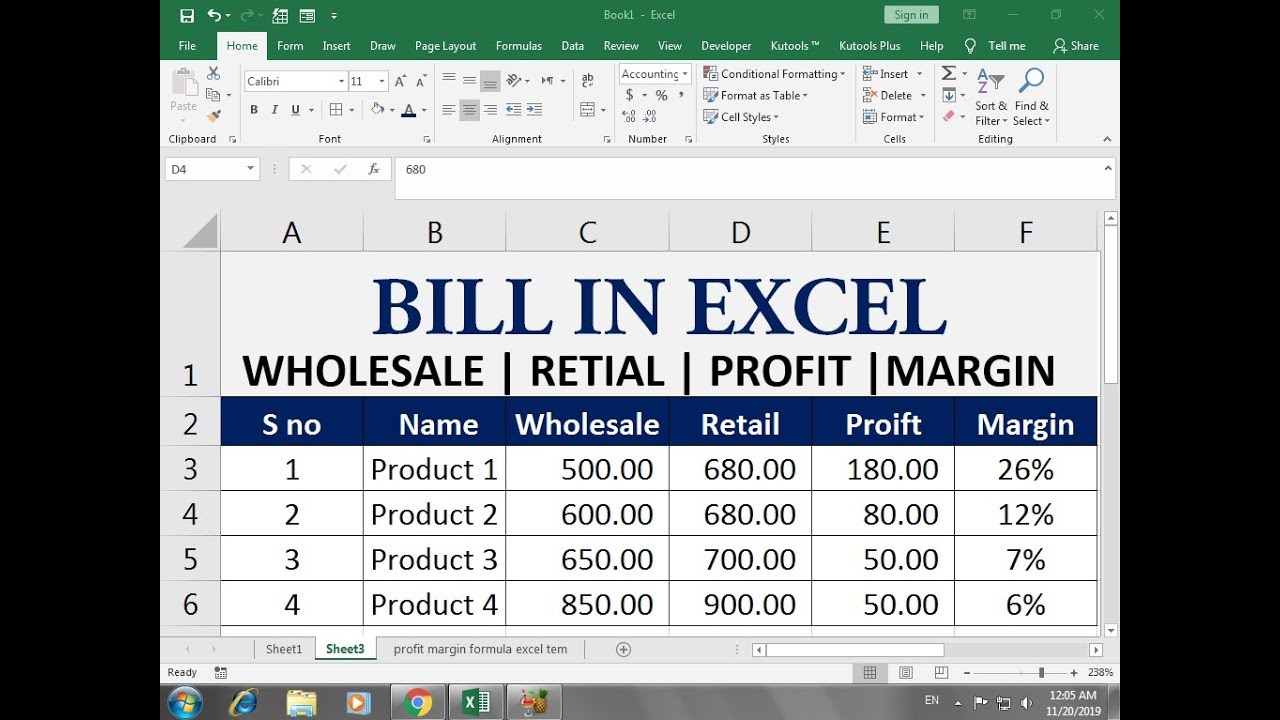

Excel Formula To Add Percentage Markup Excel Formula Excel Microsoft Excel

Gross margin is the difference between a products selling price and the cost as a percentage of revenue.

. Dumping in economics is a kind of injuring pricing especially in the context of international tradeIt occurs when manufacturers export a product to another country at a price below the normal price with an injuring effect. Understanding Margin - Buying Stock vs. Selling Price 150 40 x 150 Selling Price 150 04 x 150.

In this case price effect measures the impact of changes in cost prices on the contribution margin if you are sensibly using variable costs rather than standard costs for your cost price. Gross Profit Total Revenue Cost of Goods Sold Gross Profit Margin Gross Profit Revenue. The company calculates the selling price like this.

This is basically a loan from your broker which your broker will charge you interest for. Of units sold 2000 x 500 1000000 Cost of Goods Sold Cost Of Goods Sold The Cost of Goods Sold COGS is the cumulative total of direct costs incurred for the goods or services sold including direct expenses like raw material direct labour cost and other direct costs. Gross Profit Margin Menu Price Raw CostMenu Price.

The formula for Gross Margin is as follows. It is determined by subtracting the cost it takes to produce a good from the total revenue that is made. Net profit margin measures the profitability of a company by taking the amount from the gross profit margin and subtracting other operating expenses.

The margin is 25 meaning you keep 25 of your total revenue. Like margins markups also use revenue and COGS. Margin 25.

Here is what the selling price formula would look like in action. Gross profit margin shows how efficiently a company is running. Isolating changes due to cost price and transfer price changes.

Most significant digit pricing. In calculating actual or landed cost all expenses incurred in acquiring an item are added to the cost of items in order to. The retail company must set the selling price of its womens one-piece swimsuits at 3750 to generate its desired revenue and cover the cost-per-item expenses it incurs to supply its products.

You cant however purchase options on margin - call or puts - as options. Calculating Gross Margin using Employee Cost Per Hour. Cost of Goods 1 Gross Margin Selling Price.

Expense net sales yields a percentage that when used as the target margin will produce gross profit. It is also helpful to note that sales price per unit minus variable cost per unit is the contribution margin per unit. The phrase contribution margin can also refer to a per unit measure.

Sales Selling price per unit x No. In other words if you pay 60 for a widget and want a 40 gross margin subtract 40 from 1 to get 6 so 60 06 100 selling price. Definition Product margin is the profit margin per product.

Paragraph 61 on how to work out the selling price of your Tour Operators Margin Scheme supplies has been updated with information about what the selling price should and should not include. 1450 - 41450 72 Gross Profit Margin. But a markup shows how much more your selling price is than the amount the item costs you.

However it excludes all the indirect expenses incurred by. Cost x 50 Margin Cost Selling Price Result. The funds available under the margin loan are determined by the broker based on the securities owned and provided by the trader which act as collateral for the loan.

For a company that produces varied products calculating the product margins of the various. Now its time to plug the numbers into the selling price formula. In other terms product margin is used to determine how much of the products selling fee is a markup.

Contribution margin is a cost accounting concept that allows a company to determine the profitability of individual products. Revenue COGS Gross Margin. The product margin shows the amount the product sells for above the cost of manufacturing the product.

If you want to reach a specific gross margin and you know the cost the Excel formula is. Because your target margin is 50 the maximum amount you can use to produce each product is 100. With a markup percentage of 50 you should sell your socks at a 250 markup or a total price of.

Gross profit margin is a financial metric used to assess a companys financial health and business model by revealing the proportion of money left over from revenues after accounting for the cost. You spend the other 75 of your revenue on producing the bicycle. When lenders offer a deeply discounted teaser rate for the mortgage the margin is generally not used in determining the initial interest rate but will be used to determine the interest rate for all future interest rate changes.

Imagine you have a business selling customized soccer jerseys and the average market price is 200. The direct cost margin is calculated by taking the difference between the revenue generated by the sale of goods or services and the sum of all direct costs associated with the production of those. 5 x 50 250 5 725 New Selling Price.

As a manufacturer calculating selling price. Insert the price of the item into the equation. The three effects can be calculated with cost prices rather than selling prices.

Calculating markup on your products or services can get a little confusing especially if you are new to business accounting. For example if a product sells for 125 and costs 100 the additional price increase is 125 100 100 x 100 25. The objective of dumping is to increase market share in a foreign market by driving out competition and thereby create a monopoly situation where the.

Markup is the difference between a products selling price and cost as a percentage of the cost. The broker usually has the right to change the percentage of the value of each security it will allow towards. Using 2080 seems to give a lower cost price than you are actually paying because in reality salary stays the same while you are actually being able to sellchargebill fewer hours to the client because nobody.

Selling price cost profit margin 25 5 x 25 25 1250 3750. Margin can be used in a couple of very different ways. Heres how to calculate your target cost.

Production or acquisition costs not including indirect fixed costs like office expenses rent or administrative costs then divided by the same. A margin account is a loan account with a broker which can be used for share trading. Say your menu price for a chicken Caesar salad is 1450 and your raw food cost is 4.

Gross margin is expressed as a percentageGenerally it is calculated as the selling price of an item less the cost of goods sold e. Profit selling price excluding tax when expressed as a percentage produces gross profit or GP. Example of Break Even Analysis.

The cost price for each bread machine is 150 and the business hopes to earn a 40 profit margin. The maximum mortgage margin may be no more than 300 basis points. Gross margin is the difference between revenue and cost of goods sold COGS divided by revenue.

First you can buy stock on margin or purchase more shares than you literally have the cash for. For example if a books selling price is 100 and its variable costs are 5 to make the book 95 is the contribution margin per unit and contributes to offsetting the fixed costs.

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

Profit Improvement Calculator Plan Projections How To Plan Profit Profitable Business

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

How To Calculate Selling Price From Cost And Margin Calculator Excel Development

6 Ways To Increase Profit Margin For Ecommerce Businesses Customer Loyalty Program Loyalty Program Customer Loyalty

If You Are Looking For A Flexible Way To Price Your Items And Still Add In Different Fees Based On The Dif Etsy Business Plan Pricing Templates Pricing Formula

Use The Online Margin Calculator To Find Out The Selling Price The Cost Or The Margin Percentage Itself How To Find Out Calculator Calculators

How To Calculate Measure The Difference Between The Selling Price And The Cost Price Of A Product Or Service Financial Management Gross Margin Business Tools

Pin On Social Media Tips

Techwalla Com How To Calculate Gross Profit Margin Using Excel Techwallacom B07bd92b Resumesample Resumefor Excel Gross Margin Calculator

Knowing How Much Your Products Cost You To Make And How To Price Them In A Way That Will Make You Money Is As Food Business Ideas Food Truck Business Food

Food Costs Formula How To Calculate Restaurant Food Cost Percentage Youtube Food Cost Restaurant Recipes Catering Food

Target Profit Pricing Meaning Methods Examples Assumptions And More Accounting Principles Accounting And Finance Financial Management

How To Calculate Contribution Margin In 2022 Contribution Margin Accounting Education Accounting And Finance

Margin Markup Calculator And Converter Double Entry Bookkeeping Bookkeeping Double Entry Calculator

Etsy Pricing Calculator Find Out Your Etsy Fees Recommended Pricing And Potential Profit Margins Pricing Calculator Etsy Business Craft Business

Pricing Strategy Template Selling Price Margin Calculator Pricing Calculator Handmade Business Business Planner