25+ Fixed mortgage calculator

Offer preferential interest rates to senior citizens that may range anywhere from 025 to 075 over the regular rate of. If you would like to.

First Time Buyer Mortgages Award Winning Mortgage Broker Tony Flynn

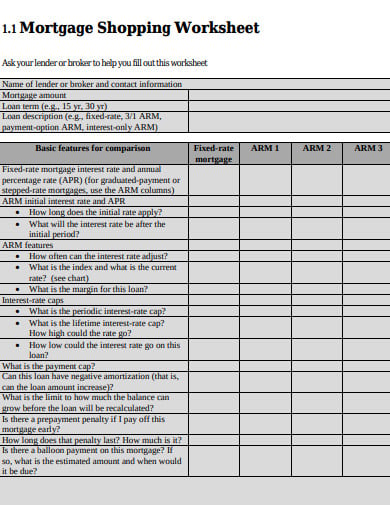

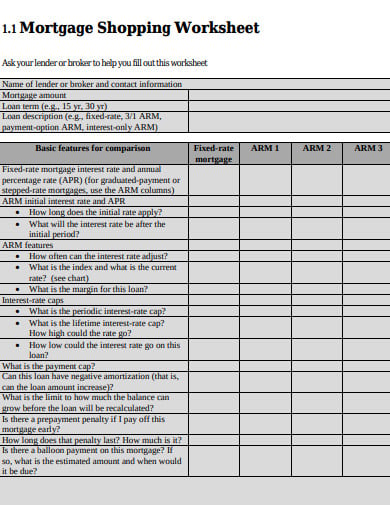

Aside from the length of your loan homebuyers also need to decide between fixed-rate mortgages when.

. Getting ready to buy a home. This tool allows you to calculate your monthly home loan payments using various loan terms interest rates and loan amounts. Out of all mortgage rates in Canada 5-year fixed mortgage rates receive the most inquiries online as of April 2012.

The mortgage term is the length of time you commit to the terms conditions and mortgage rate with a specific lender. Lower interest rate shorter terms can be 025 to 1 lower than 30-year fixed-rate loans. Across the United States 88 of home buyers finance their purchases with a mortgage.

Use our Quebec mortgage calculator to determine your monthly mortgage payment for your home purchase in Quebec. By default 250000 30-yr fixed-rate loans are displayed in the table below. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages.

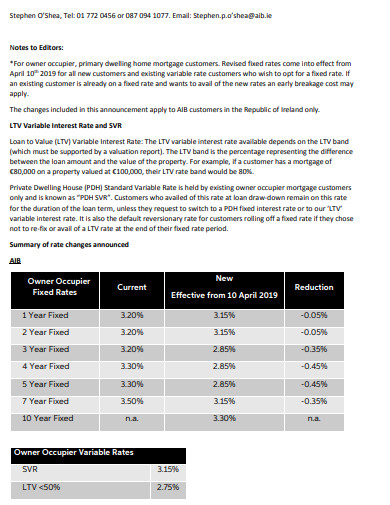

The lowest 5-year fixed mortgage rate in history was 299 percent which was offered by the Bank of Montreal in January 2012. If you take out a 30-year fixed rate mortgage this means. Total Of Payments.

Our chattel mortgage repayment calculator can help you estimate your monthly repayments total interest as well as amount payable. Using the above. How Much Will My Monthly Mortgage Payments Be.

With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. It is important to note that interest costs increase significantly if the amortization period is over 25 years. The highest average 5-year fixed mortgage rate in history was 2146 percent in September 1981.

The maximum amortization period is 25 years for. The longer your term the lower your monthly payment will be. Mortgage type The mortgage type includes the term of the mortgage between 1-10 years and the rate type variable or fixed.

Next enter your interest rate. A fixed deposit calculator is a tool designed to get an estimate about the maturity amount that the investor should expect at the end of a chosen tenure for a specified deposit amount at the applicable rate of interest. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float.

Between 1-10 years and the rate type variable or fixed. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. These are also the basic components of a mortgage.

N 30 years x 12 months per year or 360 payments. Mortgages are how most people are able to own homes in the US. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

On a 30-year fixed. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. Free online mortgage calculator specifically customized for use in the UK including amortization tables and the respective graphs.

The size of your loan the interest rate and the terms whether you have taken out your mortgage for 15 25 or 30 years. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. Well find you.

A mortgage usually includes the following key components. Home financial mortgage calculator uk. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other.

Filters enable you to change the loan amount duration or loan type. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Todays mortgage rates in Texas are 6171 for a 30-year fixed 5217 for a 15-year fixed and 5265 for a 5-year adjustable-rate mortgage ARM.

Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. Boris Johnson has now created a 25 year fixed mortgage for first-time buyers offered. What types of mortgages are there.

Youll receive a fixed. To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. Either variable rate or fixed rate.

You can generate a similar printable table using the above calculator by clicking on the Inline Schedule button. Our simple mortgage calculator with taxes and insurance makes it easy to calculate your mortgage payment without the headache of performing the tedious math yourselfor worse guesstimating what the payments might be. Free Canadian Mortgage Calculator - Use our Mortgage Calculator for Canada to calculate your monthly mortgage repayments and interest amounts.

The mortgage term is the length of time you commit to the terms conditions and mortgage rate with a specific lender.

Fed S Senior Loan Officer Survey Reflects More Normal Economy

Fed S Senior Loan Officer Survey Reflects More Normal Economy

11 Fixed Rate Mortgage Template In Doc Pdf Free Premium Templates

11 Fixed Rate Mortgage Template In Doc Pdf Free Premium Templates

Robert Elmes Director Realm Mortgages Ltd Linkedin

/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Kinetic Money Limited Home Facebook

![]()

Common Mortgage Terminologies Approvu

Meridian Mortgages

![]()

Approvu Faqs Approvu

Fed S Senior Loan Officer Survey Reflects More Normal Economy

Useful Buying Property Tools Move Iq

Social Media Displaces Phone Calls And Emails In The Uk

25 Smart Household Money Saving Tips Uk It S Not Your 9 To 5

25 Smart Household Money Saving Tips Uk It S Not Your 9 To 5

Options Morgage Services

Image 019 Jpg